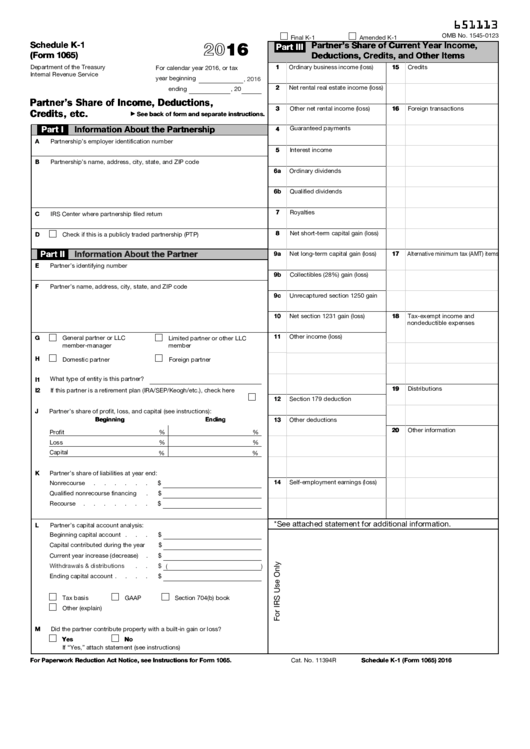

You don't file Schedule K-1 with your personal tax return. There are two versions of Schedule K-1, one for partners in partnerships and LLC owners (Form 1065, K-1) and one for shareholders in an S corporation (Form 1120S, K-1). However, LLCs have the option of following taxation rules as S corporations instead. LLCs with multiple owners are ordinarily taxed the same as partnerships, using Form 1065. Schedule K-1, then, is a bit like a W-2 form for a pass-through business owner (W-2 is the form used to report employees' income to the IRS). The form reports the owner's individual share of the business's income or loss.Įach owner reports on his or her individual tax return (Form 1040) the owner's share of the business's net profit or loss as shown on Schedule K-1. Each owner of the pass-through business fills out a Schedule K-1. Schedule K-1įorm 1065 and Form 1120S both include a separate part called Schedule K-1. This form reports the corporation's income, deductions, profits, losses, and tax credits for the year. S corporations file an information return on IRS Form 1120S, U.S. Partnerships and most LLCs with more than one owner file Form 1065, U.S. Instead, they are only informational returns that inform the IRS of the entity's income, deductions, profits, losses, and tax credits for the year. However, these forms are not used to pay taxes. If the business incurs a loss, it is likewise shared among the owners who may deduct it from other income on their individual returns, subject to certain limitations.Īlthough pass-through entities pay no taxes, they still have to file tax returns with the IRS. If the business has a profit, the owners pay income tax on their ownership share through their individual returns at their individual income tax rates. Instead, the profits, losses, deductions, and tax credits of the business get passed through the business to the owners' individual tax returns. Pass-through businessįor tax purposes, what distinguishes pass-through businesses is that they pay no taxes themselves. Such LLCs get the same treatment as sole proprietorships for tax purposes. Schedule K-1 is not needed for these businesses. This includes almost every business, except regular C corporations and sole proprietorships in which a single individual personally owns the business. Limited liability company (LLC) with two or more owners.Essentially, any company owned and operated through a pass-through business entity.

Schedule K-1 is an IRS form that is important if you are the owner or co-owner of a pass-through business.

0 kommentar(er)

0 kommentar(er)